How to Start a House-flipping Business in 7 Steps + Free Download

On the other, you may need to get creative and invest a fair amount of effort into finding buyers. Not all funding will be suitable for your business, so don’t rush yourself into a choice that could hurt you in the future. On top of that, factor in costs for https://www.wave-accounting.net/ things like materials for remodeling, permit fees, and advertising. And definitely make sure to budget for delays and hidden property problems, which can and do occur. For larger, high-risk investments such as houses, research should always come first.

Select Your Market

Flipping homes, like any investment, comes with its own set of advantages and disadvantages. It’s a hands-on investment strategy that can yield high returns, but it’s not without its challenges. Now that you know how much you can and should spend, you’re almost ready to start shopping for a house, and financing if you need it. To maximize your return, you still need to double-check that you’re taking everything into account.

Wrapping Up How to Start a House Flipping Business

The number of houses you can reasonably flip in a year depends on various factors, including your experience, team, resources, and local market conditions. On average, experienced house flippers may aim for two to five flips yearly. Scaling beyond these numbers often requires a well-established operation, access to financing, and efficient project management. Real estate investors use the 70% rule in house flipping to determine the maximum purchase price for a property to ensure a profitable flip. According to this rule, investors should not pay more than 70% of the property’s after-repair value (ARV) minus the estimated repair and carrying costs. When starting as a house-flipper, remember the significance of your professional network for your business plan.

House Flipping Business FAQs

For example, reducing package sizes saves money on materials used while lowering overall weight. A few hundred grams doesn’t sound like much, but it quickly adds up as you ship out more orders for fulfillment. That being said, having lots of content means you can focus on updating articles and outreach to get more backlinks. This might involve guest posting or cold emailing relevant companies in the same niche or similar niches with offers of backlink exchanges.

So if you plan to fix and sell a house for a profit, the sale price must exceed the cost of acquisition, renovation costs, and holding costs combined. Depending on your perspective, real estate flipping can also encompass wholesaling. This is a more formalized relationship than with a traditional bird dog, and the property in question may or may not be flipped by the eventual buyer. A wholesaler is not limited to looking at properties solely for flipping. Wholesalers also scout income properties, and longer-term appreciation plays for real estate investors. A real estate license isn’t necessary for flipping houses, but it helps.

How are you getting out of the investment? Do you have contingencies in place in case of unforeseen circumstances?

Redfin’s analysis of the market found that the number of homes being purchased are down 46% nationwide. A homeowner’s policy won’t give you the coverage you need to protect you from lawsuits, accidents, and other mishaps that can result from running a house flipping business. Even if you have a low personal credit score, you may still qualify with lenders that consider the performance of your business over credit history. Bad credit startup loans are an option, and there are some business loans that don’t require a credit check. Once you’ve been in business for at least a few months, you may need a flexible funding option to purchase properties, pay for renovations, or cover operating costs. This is a condensed version of the traditional drawn-out plan, offering information such as your objectives, a financial summary, and your industry experience.

The owner may not have updated the content in over a year, so most of the reviews are outdated. Then they hire the first contractor who makes a bid to address work that they can’t do themselves. Professionals either do the work themselves or rely on a network of prearranged, reliable contractors.

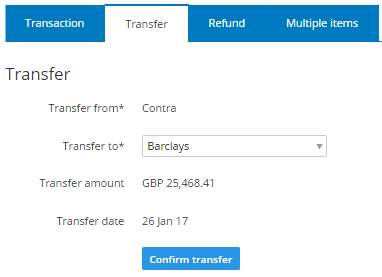

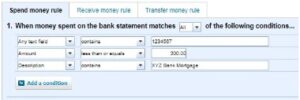

Streamline the consolidation of your investment property’s financial data from both your business banking and external accounts, all within a single, user-friendly platform. Use your first fix-and-flip project to foster relationships with industry professionals—from investors to realtors to carpenters—whose collaboration and skills you will need for your next house flip. Experienced contractors and agents can connect you with other vendors, give you leads on properties and service-providers, as well as provide advice on specific projects. Trusted contacts in the industry can also help you cover your blind spots, and make sure estimates for properties and repairs are accurate, saving you time and money. That said, you do have a wide variety of fix-and-flip loans available to you.

In the past few years, there’s been a surge of people wanting to learn how to start a house flipping business, thanks to famous renovation shows and a strong seller’s market. A record 8.4% of all home sales, or 407,417 homes, were flips in 2022, according to ATTOM Data Solutions. The study goes on to say that the average investor could see a gross profit of $67,900, and a 26.9% return on investment.

In that case, it’s more likely that you’ll also have a smooth experience with them. However, you should still check them out and vet them with an interview or meeting to ensure you choose the right professionals. In the long run, spending time and effort to choose an expert saves you time, money, and stress. Identifying your target property market might help you decide if a real estate wholesaler, auction, or a traditional broker is the right choice for your project. If you’re interested in distressed or foreclosed properties, a wholesale broker or auction will have higher volumes of properties available. A traditional broker might be right for you if the real estate market is new to you or if you need help finding a specific type of property or building.

Hard money lenders base lending on the deal itself — not your personal or business credit or lack thereof — but are usually very short-term and have high fees. If you live in or reside nearby a city or locale that you want to start flipping houses in, contact a realtor. Realtors have extensive, up-to-date https://www.online-accounting.net/invoicing-apps-invoice2go-easy-invoice-maker-on/ information on what houses are prime for selling and where they’re located. Creating a budget and calculating each project is an important part of your house-flipping checklist. Use the free house-flipping calculator to generate your potential profits when shopping and evaluating potential properties.

Understanding the reality behind these misconceptions can prepare you for success and ensure that false assumptions don’t keep you from exploring the profitable potential of flipping houses. After investors choose the right market, it is chart of accounts: definition types and how it works time to begin searching property listings. Websites like Zillow.com and Realtor.com are great places to start. Investors should also search public records and newspapers for foreclosure listings, which can represent profitable flips.

- By following these steps, you can create a business plan that is attractive to investors, mitigates potential risks, and sets your business up for success.

- You’re much more likely to find success if you pick a business that’s in a niche you have some interest in.

- Before investors begin searching for funding, it is important to assess their current financial situation.

- Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity.

- Here is a link to a 70% rule calculator if you would like to use your own property and estimate your figures.

This means that it may be more expensive to find a house to purchase, but that the improvements you make could have an even higher ROI than normal. Below are a few examples of common scenarios where you’ll need to explain your contingency plans. You also need to address contingencies in case the project doesn’t go as planned. You may need to seek the advice of an attorney or accountant to fully understand the implications of each organization type.

The world of real estate offers numerous opportunities for investors to make a profit. One of the most popular strategies in recent years has been house flipping, which involves purchasing a property, renovating it, and reselling it at a premium. However, to make a successful house-flipping business, you need more than just a good eye for potential properties. You also need a solid business plan that attracts investors and ensures project success.