Fill In The Blank The Statement Of Retained Earnings Explains Changes In Equity From Net Income or

Any item that impacts net income (or net loss) will impact the retained earnings. Such items include sales revenue, cost of goods sold (COGS), depreciation, and necessary operating expenses. Retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. what does a retained earnings statement look like As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company. First, financial statements can be compared to prior periods to understand changes over time better.

- If your business currently pays shareholder dividends, you’ll need to subtract the total paid from your previous retained earnings balance.

- If a good has a comparative advantage over another, that good must also have a comparative disadvantage.

- A retained earnings statement is one concrete way to determine if they’re getting their return on investment.

- Remember to interpret retained earnings in the context of your business realities (i.e. seasonality), and you’ll be in good shape to improve earnings and grow your business.

- Learn how to put a price on your business, and how to judge the value of a business you want to buy.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

How to Prepare a Statement of Retained Earnings

This number’s a must.Ultimately, before you start to grow by hiring more people or launching a new product, you need a firm grasp on how much money you can actually commit. The figure is calculated at the end of each accounting period (monthly/quarterly/annually). As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term.

Do you already work with a financial advisor?

If your retained earnings account is positive, you have money to invest in new equipment or other assets. If your retained earnings are negative, you have a deficit. Yes, retained earnings carry over to the next year if they have not been used up by the company from paying down debt or investing back in the company.

What is the Retained Earnings Formula?

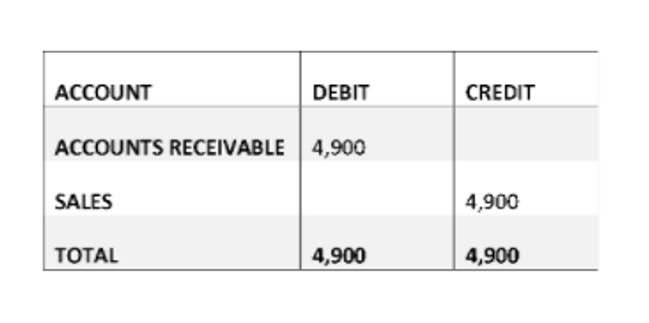

You calculate retained earnings at the end of every accounting period. Retained earnings are calculated by subtracting a company’s total dividends paid to shareholders from its net income. This gives you the amount of profits that have been reinvested back into the business. The statement of retained earnings can be created as a standalone document or be appended to another financial statement, such as the balance sheet or income statement.

However, note that the above calculation is indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company. Both revenue and retained earnings are important in evaluating a company’s financial health, but they highlight different aspects of the financial picture. Revenue sits at the top of the income statement and is often referred to as the top-line number when describing a company’s financial performance.

Retained Earnings Formula and Calculation

The use of goods and services to satisfy the needs and desires of both individuals and groups is related to this. Operating activities, investing activities, and financing activities are the three types οf cash flοws. On the other hand, consumer behavior is extremely complicated because it involves a person’s individual mindset, preferences and attitudes, and consumption levels. Particularly during times of financial difficulty, consumers experience a shift in their standard of living, which has an effect on their preferences and level of consumption spending. However, also it’ll come as a system of the class If we add a return type to a constructor.

- First, as I mentioned earlier, we’ve had a strong start to the year.

- During the same period, the total earnings per share (EPS) was $13.61, while the total dividend paid out by the company was $3.38 per share.

- If you can quantify the benefit to property taxes that you saw in the quarter and just clarify if it’s onetime in nature or not?

- Net income increases Retained Earnings, while net losses and dividends decrease Retained Earnings in any given year.

- Mass marketing communications entails the use of undifferentiated targeting approaches wherein entire markets are pursued.

- By comparing retained earnings balances over time, investors can better predict future dividend payments and improvements to share price.

- The surplus can be distributed to the company’s shareholders according to the number of shares they own in the company.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Lenders want to lend to established and profitable companies that retain some of their reported earnings for future use.

- This financial statement shows a company’s total change in income, even gains and losses that have yet to be recorded in accordance with accounting rules.

- Not sure if you’ve been calculating your retained earnings correctly?

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. There’s a lot of hidden costs invested in a product by the time you sell it.

How can I track my company’s retained earnings?

You’re our first priority.Every time.